Wealth Inequality, Network Topology and Financial InstabilityJournal of Income Distribution (2021) doi:10.25071/1874-6322.40445 link

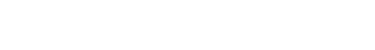

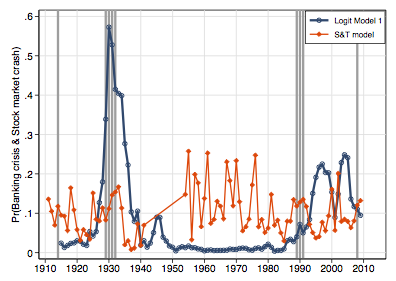

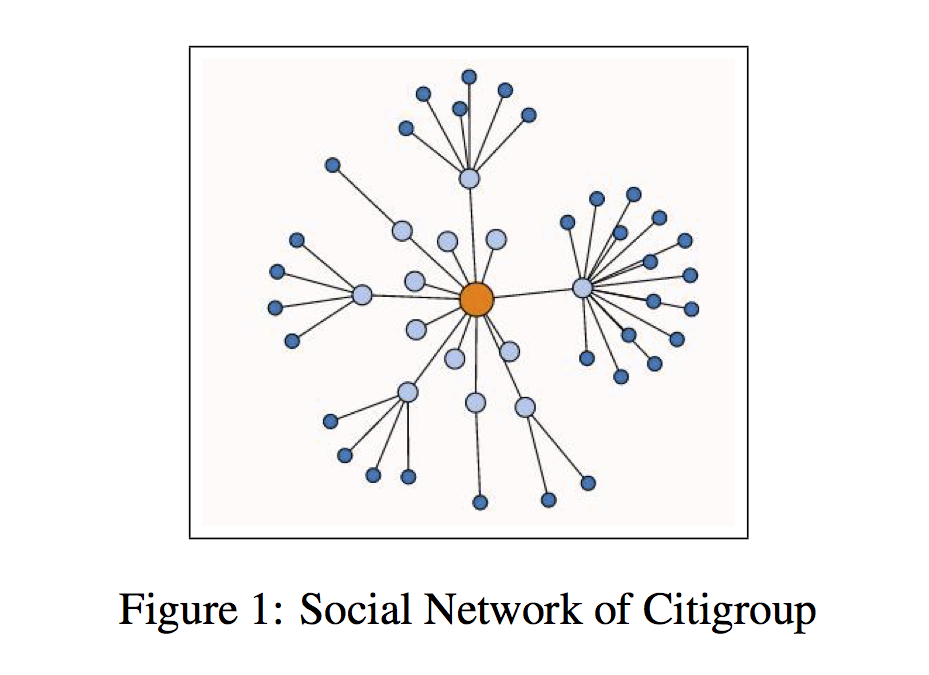

Abstract:This article asks ’if two otherwise identical economies were distinguishedonly by their distributions of wealth, are they equally stable in response toa random shock?’ A theoretical financial network model is proposed tounderstand the relationship between wealth inequality and financial crises.In a financial network, financial assets link individual asset and liabilityholders to form a web of economic connections. The total connectivity of anindividual is described bydegree; the overall distribution of connections inthe network is imposed through adegree distribution– equivalent to thewealth distribution – as incoming connections represent assets and outgoingconnections, liabilities. A network’s topology varies with the level of wealthinequality and total wealth and simulations show that together, theydetermine network contagion in the event of a random negative incomeshock to some individuals. Random network simulations, whereby eachfinancial connection is randomly placed, reveal that increasing wealthinequality makes a wealthy network less stable – as measured by the shareof individuals failing financially or the decline in financial asset values.These results suggest a unique architectural role for accumulated assets andtheir distribution in macro-financial stability.

.pdf